Enhance Your Financial Security With A Reverse Mortgage From MTP

Looking for ways to supplement your retirement income? A reverse mortgage could help you tap into the equity in your home to gain additional funds. Contact MTP Mortgage today for more information:

Looking for ways to supplement your retirement income? A reverse mortgage could help you tap into the equity in your home to gain additional funds. Contact MTP Mortgage today for more information:

Improve your monthly cash flow

Pay off your existing mortgage

Continue to live in your home

Fund necessary home repairs or renovations

Build a safety net for unplanned expenses

Pay off medical bills, vehicle loans and other debts

Improve your monthly cash flow

Build a safety net for unplanned expenses

Pay off your existing mortgage

Continue to live in your home

Fund necessary home repairs or renovations

Pay off medical bills, vehicle loans and other debts

The Benefits

Get rid of your monthly mortgage payments1

You get to stay in your home and maintain the title1

Your heirs inherit any remaining equity after pay-off

Loan proceeds are not taxed2

Receive your funds in a lump sum3, regular monthly payments, a credit line, or a combination thereof

FHA Insured4

The Benefits

Get rid of your monthly mortgage payments1

You get to stay in your home and maintain the title1

Your heirs inherit any remaining equity after pay-off

Loan proceeds are not taxed2

Receive your funds in a lump sum3, regular monthly payments, a credit line, or a combination thereof

FHA Insured4

Are You Eligible?

Applying for a reverse mortgage HECM loan is simple here at MTP Mortgage of Texas. To be eligible, some key requirements are:

Are You Eligible?

Applying for a reverse mortgage HECM loan is simple here at MTP Mortgage of Texas. To be eligible, some key requirements are:

Youngest borrower must be at least 62 years old

Must have sufficient equity in your home

Property must be a single family residence, an owner occupied 2-4 unit home, a condo approved by HUD, or a manufactured home that meets FHA guidelines

Must meet financial assessment requirements as established by HUD

How A Reverse Mortgage Loan Works

An FHA insured Home Equity Conversion Mortgage (HECM) is commonly known as a “reverse mortgage.” It is a loan that lets you access your home’s equity to get cash for your retirement funding needs.

In general, the older you are, the more equity you have in your home and the lower your mortgage loan balance; the more money you can expect from a HECM loan.

If you are 62 years of age or older and have sufficient home equity, you may be able to obtain this loan. Contact us to see if you can qualify.

How A Reverse Mortgage Loan Works

An FHA insured Home Equity Conversion Mortgage (HECM) is commonly known as a “reverse mortgage.” It is a loan that lets you access your home’s equity to get cash for your retirement funding needs.

In general, the older you are, the more equity you have in your home and the lower your mortgage loan balance; the more money you can expect from a HECM loan.

If you are 62 years of age or older and have sufficient home equity, you may be able to obtain this loan. Contact us to see if you can qualify.

Click to Call Us Now

Or Dial (214) 644-0610

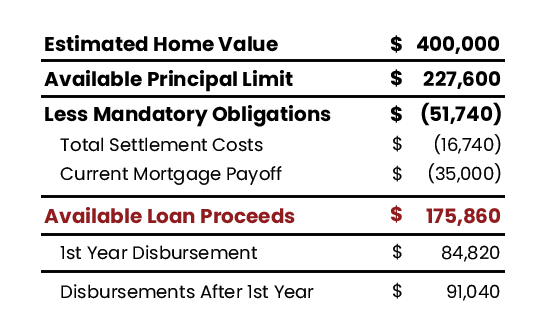

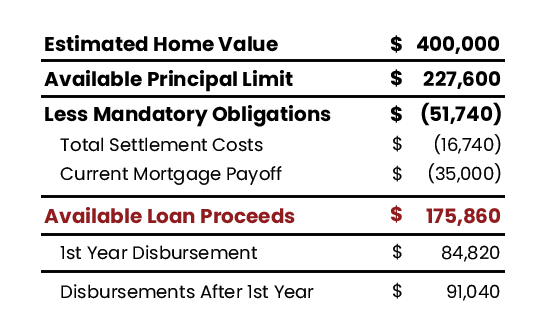

Case Study for a Reverse Mortgage5

Bob and Mary are a retired couple, aged 71 and 69 who want to stay in their home but would like to boost their monthly income to cover normal living expenses, and build a safety net for unexpected expenses.

They decide to contact MTP Mortgage of Texas to discuss their needs and future goals. An FHA appraiser assesses their home’s value at $400,000. They currently owe $35,000 on their mortgage, which gives them $227,600 in equity. Bob and Mary will have access to $175,860 of their equity from the reverse mortgage loan.